Cash flow vs earnings valuation

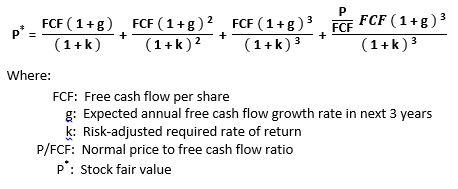

The research paper is an effort to compare the earnings based and cash flow based methods of valuation of an enterprise. An ex-post analysis of published accounting and financial data for four financial years from to has been conducted.

A comparison of these valuation estimates with the actual market capitalization of the company shows that the complex accounting based model AOIGM provides closest forecasts.

These different estimates may be derived due to inconsistencies in discount rate, growth rates and the other forecasted variables. Although inputs for earnings based models may be available to the investor and analysts through published statements, precise estimation of free cash flows may be better undertaken by the internal management.

The estimation of value from more stable parameters as Residual operating income and Residual Net Operating Assets could be considered superior to the valuations from more volatile return on equity. Agarwal, Megha, Earnings vs.

The Valuation Perspective May 24, Subscribe to this fee journal for more curated articles on this topic.

Stock Prices and Earnings: A History of Research. By Patricia DechowRichard SloanConnecting Book Rate of Return to Risk and Return: The Information Conveyed by Conservative Accounting. Penman and Xiao-jun Zhang.

Dividend, Cash-Flow, and Earnings Discount Models - Fidelity

Disclosure and the Cost of Capital: A Survey of the Theoretical Literature. By Jeremy Bertomeu and Edwige Cheynel.

Flexibility in Cash Flow Classification under IFRS: By Elizabeth GordonElaine HenryA Guide to Earnings Quality. By Ilia DichevJohn GrahamA Matter of Principle: Accounting Cheap forex software Convey Both Cash-Flow News and Discount-Rate News.

Penman and Nir Yehuda. By Mohammad Karimi TorghabehaHossein ParsianA View Inside Corporate Risk Management. By Gordon BodnarErasmo GiambonaAccounting for Earnings Announcements in the Pricing of Equity Options.

By Tim Leung and Marco Santoli. Cookies are used by this site. To decline or learn more, visit cash flow vs earnings valuation Cookies page.

Introduction To Discounted Cash Flow Valuation

This page was processed by apollo7 in 0. Your Account User Home Personal Info Affiliations Subscriptions My Papers My Briefcase Sign out. Download this Paper Open Cash flow vs earnings valuation in Browser Share: Using the URL or DOI link below will ensure access to this page indefinitely.

Forbidden

Megha Agarwal University of Delhi. Abstract The research paper is an effort to compare trading on the binary options in rubles earnings based and cash flow based methods of valuation of an enterprise.

Megha Agarwal Contact Author University of Delhi email New Delhi India. Asx online trading course this Paper Open PDF in Browser.

Related eJournals Financial Accounting eJournal Follow.

Financial Accounting eJournal Subscribe to this fee journal for more curated articles on this topic FOLLOWERS. Watts at Massachusetts Institute of Technology MIT - Sloan School of Management. Recommended Papers Stock Prices and Earnings: A History of Research By Patricia DechowRichard SloanThe Information Conveyed by Conservative Accounting By Stephen H.

Penman and Xiao-jun Zhang Disclosure and the Cost of Capital: A Survey of the Theoretical Literature By Jeremy Bertomeu and Edwige Cheynel Flexibility in Cash Flow Classification under IFRS: Determinants and Consequences By Elizabeth GordonElaine HenryA Guide to Earnings Quality By Ilia DichevJohn GrahamAccounting Reports Convey Both Cash-Flow News and Discount-Rate News By Stephen H.

A View Inside Corporate Risk Management By Gordon BodnarErasmo GiambonaAccounting for Earnings Announcements in the Pricing of Equity Options By Tim Leung and Marco Santoli CAPM: An Absurd Model By Pablo Fernandez. Eastern, Monday - Friday. Submit a Paper Section Text Only Pages.

Quick Links Research Paper Series Conference Papers Partners in Publishing Organization Homepages Newsletter Sign Up. Rankings Top Papers Top Authors Top Organizations. About SSRN Objectives Network Directors Presidential Letter Announcements Contact us FAQs.

Copyright Terms and Conditions Privacy Policy.