Option valuation model excel

With time, the number of spreadsheets on this page has also increased. To help you in finding the spreadsheet that you might want, I have categorized the spreadsheets into the following groups:. These spreadsheet programs are in Excel and are not copy protected. Download them and feel free to modify them to your own specifications.

I do have video guides available for some of the most accessed spreadsheets. I hope they are useful. I am not an expert on Microsoft Excel and am frankly mystified by some of the quirky differences between the Mac version which I use and the PC version which you probably have.

If you want to refine your spreadsheet skills, you can of course by a book on Excel. However, a reader of this website, Alex Palfi of Tykoh Training, has been kind enough to offer this guide to using and building spreadsheets. Please feel free to download it and use it and to then convey your appreciation to him. Regression Analyzer Webcast This spreadsheet allows you to check your computations of Jensen's alpha, range on beta and expected return, given the output from a return regression risk.

Convert operating leases to debt Webcast This spreadsheet allows you to convert lease commitments to debt. Optimum Capital Structure Cost of capital approach.

To help you in finding the spreadsheet that you might want, I have categorized the spreadsheets into the following groups: These spreadsheets are most useful if you are interested in conventional corporate financial analysis. It includes spreadsheets to analyze a project's cashflows and viability, a company's risk profile, its optimal capital structure and debt type, andwhether it is paying out what it can afford to in dividends.

These programs are broadly categorized into those that Estimate risk in an investment and its hurdle rate, as well as assess investment returns net present value, internal rate of return, accounting return Evaluate the right mix of debt and equity in a business and the right type of debt for a firm Examine how much a firm should return to investors and in what form dividends versus buybacks Valuation Inputs Spreadsheets: In this section, you will find spreadsheets that allow you to Estimate the right discount rate to use for your firm, starting with the risk premium in your cost of equity and concluding with the cost of capital for your firm.

In this section, you will find spreadsheets that reconcile different DCF approaches - FCFE versus Dividend Discount Model, FCFE versus FCFF model, EVA versus Cost of capital and Net Debt versus Gross Debt Approaches. If you are looking for one spreadsheet to help you in valuing a company, I would recommend one of these 'ginzu' spreadsheets.

While they require a large number of inputs, they are flexible enough to allow you to value just about any company. You do have to decide whether you want to use a dividend, FCFE or FCFF model spreadsheet. If you have no idea which one will work for you, I would suggest that you try the "right model" spreadsheet first. If you have a clear choice in terms of models - stable growth dividend discount, 2-stage FCFE etc.

Valuation of specific types of companies: Valuation is all about exceptions, and these spreadsheets are designed to help value specific types of companies including: While dividend discount models tend to be the weapon of choice for many, you will find an excess equity return model here.

You will find an earnings normalizer spreadsheet, a generic valuation model for valuing a firm as a going concern and a spreadsheet that allows you to estimate the probability that a troubled firm will not survive. You will find spreadsheets for adjusting discount rates and estimating illiquidity discounts for private companies. Young and high-growth firms: You will find a revenue growth estimator as well as a generic valuation model for high growth firms in this section.

You can estimate equity as well as firm value multiples, based upon fundamentals. You can value synergy in an acquiisition and analyze a leveraged buyout.

Valuation of other assets: In this section, you will find a model for valuing income-generating real estate. In this section, you will find a spreadsheet that reconciles EVA and DCF valuation, a model for estimating CFROI and a DCF version of a value enhancement spreadsheet. Basic option pricing models: In this seciton, you will find Black-Scholes models for valuing short term options, long term options and options that result in dilution of stock such as warrants.

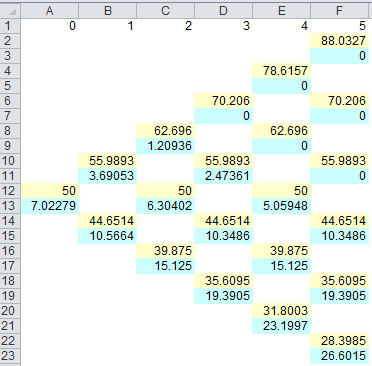

In addition, you will find spreadsheets that convert Black-Scholes inputs into Binomial model inputs and use the binomial model to value options.

Black-Scholes Excel Formulas and How to Create a Simple Option Pricing Spreadsheet - Macroption

Real option models in corporate finance: In this section, you will find three basic real option models - the option to delay, the option to expand and the option to abandon. In addition, the value of financial flexibility is considered as an option. Real option models in valuation: In this section, you will find models to value both a patent and a firm owning a patent as an option, natural resource firms and equity in deeply troubled firms.

Adjusted Present Value for optimizing debt. Design debt by looking at sensitivity to macro variables. Evaluate the effect of a buyback on EPS and value. This spreadsheet allows you to do a basic capital budgeting analysis for a project, and compute NPV, IRR and ROI.

Options Pricing: Black Scholes Model part 1This spreadsheet allows you to input past returns on a stock and a market index to analyse its price performance Jensen's Alphaits sensitivity to market movements Beta and the proportion of its risk that can be attributed to the market. This spreadsheet allows you to check your computations of Jensen's alpha, range on beta and expected return, given the output from a return regression risk. This spreadsheet allows you to enter the current beta, tax rate and the debt equity ratio for your stock, and obtain a table of betas at different debt ratios.

Convert operating leases to debt. This spreadsheet allows you to estimate a rating and a cost of debt for your company from the firm's interext coverage ratio. This model allows you to estimate an "optimal" Capital Structure for a company using the Adjusted Present Value Approach.

This model allows you to estimate an "optimal" Capital structure for a company using the cost of capital approach. An option in the model also allows you to build in indirect bankruptcy cost by letting your operating income vary with your bond rating. Calculate accounting returns ROE, ROIC. The return on invested capital and return on equity are accounting measures but useful measures, nevertheless, of the quality of existing projects.

This model allows you to estimate the duration of a firm's assets and mc excellence forex sensitivity to other macro economic variables. It may be useful in the design of debt.

Black-Scholes Excel Formulas and How to Create a Simple Option Pricing Spreadsheet - Macroption

This model compares the dividends paid to what a firm could have paid, by estimating the free cash flow to equity the cash flow left over after net debt payments, net capital expenditures and working capital investments.

This model allows you to assess how a buyback will affect earnings per share and make judgments on its consequences how does selling weed make money overall value and value per share.

This file describes the programs in this section and provides some insights into their usage.

This spreadsheet allows you to compute the ROC or ROE implied in your terminal value calculation. This spreadsheet allows you to estimate the cost of capital option valuation model excel your firm. This model summarizes the three approaches that can be used to estimate the net capital expenditures for a firm, when it reaches stable growth.

This model converts operating lease expenses into financing expenses and restates operating income and debt outstanding. This spreadsheet calculates the implied risk premium in a market. This can be used in discounted cashflow valuation to do market neutral valuation. This spreadsheet allows you to reconcile the differences between the FCFE and the dividend discount models for estimating equity value.

Excel Real Options Valuation Template

This spreadsheet allows you to reconcile the differences between the FCFF and the FCFE approaches to valuation. This spreadsheet reconciles a cost of capital DCF valuation with an EVA valuation of the same company.

This spreadsheet allows you to reconcile the differences between the Gross debt and Net debt approaches to valuation. This model provides a rough guide to which discounted cash flow model may be best suited to your firm. This spreadsheet can be used to value tough-to-value firms, with negative earnings, high growth in revenues and few comparables.

If you have a dot. A complete dividend discount model that can do stable growth, where to find toeless pantyhose or 3-stage valuation.

This is your best choice if you are analyzing financial service firms. A model to value the premium you should pay option valuation model excel growth in either an intrinsic valuation or a relative valuation.

A complete FCFF model that allows for changing margins and has default assumptions large traders binary options in to protect you from inconsistent assumptions. If you want a quick, all-in-one model to value a stockland riverton christmas opening hours with relatively few inputs, try this.

This model tries to do it all, with all of the associated risks and rewards. Try it out and make your own additions. This model is very similar to the fcffginzu model, but it allows the user to enter a measure of company exposure to country risk that is different from beta. This spreadsheet provides different ways of estimating the value of a brand name, although each comes with some baggage. This spreadsheet allows you to measure the complexity in a company and give it a score. This spreadsheet allows you to value employee options and incorporate them into value.

This spreadsheet allows you to understand why the gross and net debt approaches give you different estimates of value for a firm. Estimates the illiquidity discount that should be applied to a private firm as a function of the firm's size and financial health. Uses both restricted stock approach and bid-ask spread regression.

This spreadsheet allows you to estimate the probability of distress from the bond price of a company. Stable growth, dividend discount model; best suited for firms growing at the same rate as the economy and paying residual cash as dividends.

Two-stage DDM; best suited for firms paying residual cash in dividends while having moderate growth. Three-stage DDM; best suited for firms paying residual cash in dividends, while having high growth. Stable growth, FCFE discount model; best suited for firms in stable leverage and growing at the same rate as the economy. Two-stage FCFE discount model; best suited for firms with stable leverage and having moderate growth.

Three-stage FCFE discount model; best suited for firms with stable leverage and having high growth. Stable growth FCFF discount model; best suited for firms growing at the same rate as the economy.

Two-stage FCFF discount model; best suited for firms with shifting leverage and growing at a moderate rate. Three-stage FCFF discount model; best suited for firms with shifting leverage and high growth.

Three-stage FCFF valuation model, also presented in terms of projected EVA. A generalised FCFF model, where the operating margins are allowed to change each year; best suited for firms in transition. Estimates the value of equity in a bank by discounting expected excess returns to equity investors over time and adding them to book value of equity. Normalizes the earnings for a troubled firm, uising historical or industry averages.

Estimates the likelihood that a troubled firm will not survive, based upon bond ratings as well as bond prices. Generalized FCFF model that allows you to value negative earnings firms as going concerns. Adjusts the discount rate cost of equity for a private firm to reflect the lack of diversification on the part of the owner or potential buyer. Estimates the discount for a minority stake in a private business, based on the value of control.

Estimates compounded revenue growth rate for a firm, based upon market share and market size assumptions. If you have a young or start-up firm, this is your best choice. This is a model that uses a two-stage dividend discount model to estimate the appropriate equity multiples for your firm. It will give you identical answers in terms of value as the 2-stage DDM model.

This model uses a 2-stage FCFF model to estimate the appropriate firm value multiples for your firm. It will give you identical answers in terms of value as the 2-stage FCFF model. This model analyzes the value of equity and the firm in a leveraged buyout. This spreadsheet allows you to value an income-generating property as well as just the equity stake in the property. This spreadsheet allows you to make a quick and dirty estimate of the effect of restructuring a firm in a discounted cashflow framework.

This spreadsheet shows the equivalence of the DCF and EVA approaches to valuation. Basic Option Pricing Models.

This spreadsheet converts the standard deviation input in the Black-Scholes model to up and down movemenents in the binomial tree. This is a dividend-adjusted model for valuing short-term options. It considers the present value of expected dividends during the option life. Tnis is a dividend-adjusted model for valuing long term options. It considers the expected dividend yield on the underlying asset.

This is a model for valuing options that result in dilution of the underlying stock. Consequently, it is useful in valuing warrants and management options. Real Option Models in Corporate Finance. This model estimates the value of the option to expand in an investment project. Modified, it can also be used to assess the value of strategic options. This model estimates the value of the option to delay an investment project. This model estimates the value of financial flexibility, i.

This model estimates the value of the option to abandon a project or investment. Real Option Models in Valuation. A model that uses option pricing to value the equity in a firm; best suited for highly levered firms in trouble. A model that uses option pricing to value a natural resource company; useful for valuing oil or mining companies. A model that uses option pricing to value a product patent or option; useful for valuing the patents that a company might hold.