Options trade net debit

June 10, by m slabinski. A vertical option spread is when you buy and sell options of the same type put or call , in the same underlying, and in the same expiration cycle.

You can think of a vertical spread as buying or selling an option vertically above another option of the same type. Another way to refer to a credit or debit spread is being short or long a spread. Essentially, in a credit spread you collect more money for the option you sell than you pay for the option you buy a net credit. In a debit spread, you pay more for the option you buy than you receive in credit for the option you sell a net debit.

Higher strike price put options are worth more have higher premium than lower strike price put options.

It is more valuable to be able to sell something for a higher price than a lower price. Lower strike price call options are worth more have higher premium than higher strike price call options. It is more valuable to be able to buy something for a lower price than a higher price.

Using these two general rules and knowing that long vertical spreads will have a net debit and short vertical spreads will have a net credit you will be able to figure out where the option you sell and where the option you buy will relatively be located.

In a long call vertical spread, you buy the call with a lower strike price higher premium and sell the call with a higher strike price lower premium for a net debit.

Credit spread (options) - Wikipedia

In a long put vertical spread, you buy the put with a higher strike price higher premium and sell the put with a lower strike price lower premium for a net debit. In a short call vertical spread you buy the call with a higher strike price lower premium and sell the call with a lower strike price higher premium for a net credit. In a short put vertical spread you buy the put with a lower strike price lower premium and sell the put with a higher strike price higher premium for a net credit. In the next part of the series, we will focus on how to set up short verticals in dough, what the risk and profit potentials are, and how things like theta decay and implied volatility affect the trade throughout its duration.

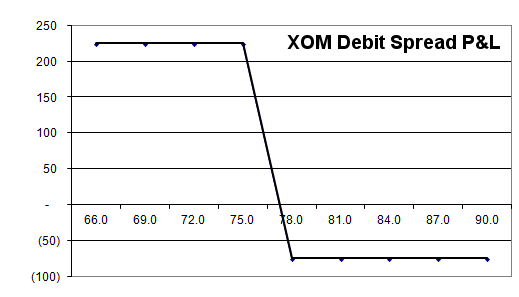

There are two types of vertical option spreads: Email us at dough support. In part 3 of our series on vertical option spreads, we go over long vertical spreads, also known as debit spreads.

Debit Spread, Net Debit Option Trades

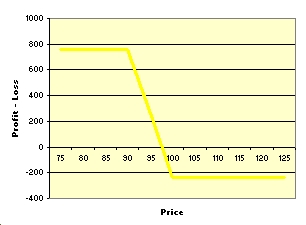

Who are you calling short? In part 2 of vertical option spreads, we go over short vertical spreads, also known as credit spreads. Vertical option spreads, also known as credit and debit spreads, are a favorite defined risk trade for option traders. Beginner intermediate Blog Sign Up Login.

Vertical Options Part 1. What is a vertical option spread? If you receive a net credit for the spread, it is a credit spread. If you pay a net debit for the spread, it is a debit spread.

If you are short a spread, it means you sold it and collected a credit a short option spread is a credit spread. If you are long a spread, it means you bought it and paid a debit a long option spread is a debit spread. In dough you will see vertical option spreads referred to as long and short.

Option Spreads: Debit Spreads Structure

Vertical Options part 2: Read Part 2 here! Vertical Options Part 1 Recap: Jul 14, beginner Trading strategy , defined risk , bearish , vertical , spread m slabinski Comment. Vertical Options Part 3: Trading a Long Vertical Spread.

Jul 7, beginner Trading strategy , defined risk , vertical , spread m slabinski Comment. Vertical Options Part 2: Trading a Short Vertical Spread. Jun 10, beginner vertical , spread , Trading strategy , puts , calls m slabinski Comment.