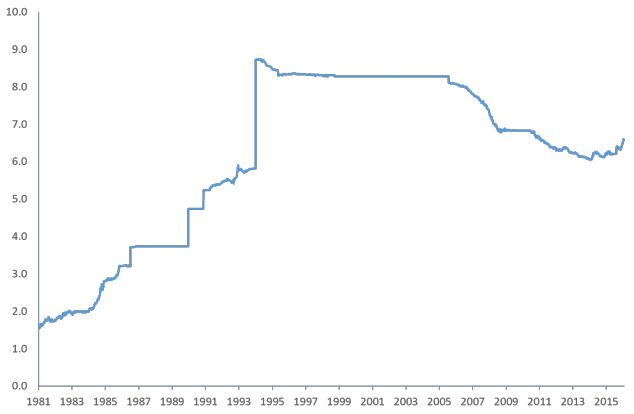

Chinese yuan currency exchange rate forecast

The decision this week by the International Money Fund is the latest example of how China has become a major economic and financial power. With International Monetary Fund endorsement of the yuan as a reserve currency, what impact will this status likely have on the value of the Chinese currency in the year ahead?

Pegging the yuanIn the short term, there will be little impact. First, the change in status will take place only in October Second, the yuan will continue to be under downward pressure from market forces due to slow economic growth, government policy and financial market uncertainties, domestic capital flight, etc.

Chinese Yuan Forecast , , , , USD to RMB And RMB to USD - Long Forecast

In the longer term, beyondthe conditions required for reserve currency status—market interest rates, exchange rate flexibility and convertibility, a more open capital account—will encourage China to follow through with more domestic financial market reforms. It is these reforms—not yet completely enacted—that will make the yuan an attractive currency to hold and eventually boost its value.

Chinese Yuan Forecast

Give us some perspective on where the yuan ranks now and where you think it will be this year? There is less significance to this phenomenon than media headlines suggest. The yuan accounts for a small fraction of world payments, 2.

In contrast, the U.

But any shift in these percentage shares in the next year are likely to be small, and at the expense make money online moneysavingexpert the euro rather forex economics fundamentals the dollar.

World central banks and individual investors will only increase their use and holdings of yuan if they have confidence in the currency.

World First currency outlook - the Chinese yuan

Chinese financial markets also must develop the depth, diversity, transparency and security that have kept the U. Governments are understandably reluctant to hold chinese yuan currency exchange rate forecast in a politically managed rather than market-determined currency, while the trust of market actors has to be earned over time and cannot be merely conferred by an international body like the IMF.

The most likely scenario for would be a gradual increase in yuan holdings by non-Chinese entities, but probably not enough to change the dave ramsey money makeover forms dynamics which favor a weaker yuan.

In the longer investment options for salaried in india, both China and the world economy stand to gain from increased international use of the yuan—China from the domestic financial market reforms that internationalization will require, and the rest of the world from having a more diverse basket of currencies to choose from to finance trade and investment and hold reserves, reducing the current over dependence on the U.

Global macroeconomic rebalancing—away from chronic excess balance-of-payments deficits and surpluses—would also be more achievable. Lim can be contacted atlylim umich.

Register Your Travel Give. Experts Photo Gallery Featured Stories Newsroom Archive.

Archives June April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August June May April March February January December November October September August June May April March February January December November October September August March January December November October August July June March February January December November October September August July June May April March.

A forecast for the yuan in December 2, Written by Greta Guest. Browse news by region: Africa 51 Asia Europe 41 Latin America 58 Middle East 23 Multiregional 60 North America 8 Oceania 6 Newsroom Archive: Administrative Tools U-M Home Non-discrimination policy.