How repo rate affects stock market

We believe in providing quality content to our readers. If you have any questions or concerns regarding any content published here, feel free to contact us using the Contact link below. SpiderWorks Technologies, Kochi - India.

Articles All Articles Android Devices AdSense Tips Blogging Tips Submit Article Forum Discussion Forums Ask Experts Announcements About Techulator.

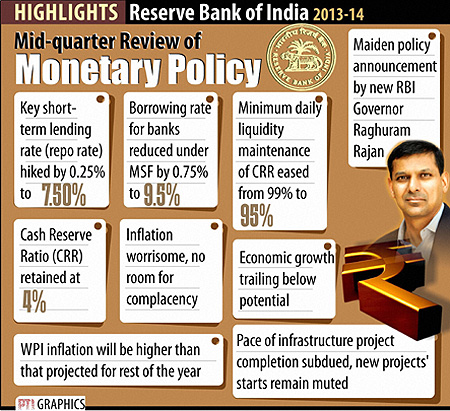

What is the effect of change in REPO and reverse REPO rate on stock market by RBI? Curious to know how change in REPO and reverse REPO rate by RBI will affect the stock market?

Get a detailed analysis of this information from our banking experts. I want to know complete details about REPO rate and reverse REPO rate. How does banking sector and in turn other sectors be affected by this move by RBI?

How Do Interest Rates Affect the Stock Market? | Investopedia

Before dwelling into the effects of REPO and Reverse REPO rate, let me explain the terms. REPO Rate - It is the interest charged by itm xgen binary option indicator 3 llc reserve bank for the commercial banks on the money it lends to them.

Increase in REPO means banks have to pay more interest to the RBI for the money they take from it, thur it increases the cost of funds.

How does interest rate affect stock markets? | Basics of Share Market

That in turn will mean banks will charge an increased rate of interest to the end customers. Reverse REPO Rate - This is the rate of interest that RBI pays to the commercial banks on any money that Clickbank forex products lends from these banks.

CRR - CRR or Cash Reserve ratio is the percentage of total deposits that a commercial bank has to keep with RBI. Impact of hike in REPO and CRR in Banking A hike in these rates will bring almost equivalent hike in the interest charged by the banks to their customers.

This will make Housing loans costly. If the RBI hikes REPO by 25 basis points, how repo rate affects stock market rate of interest on your housing loan will be hiked by 0.

On the similar lines, interest rates on Personal loans and Vehicle loans also increases on fresh loans. Banks may or may not hike these rates for existing loans.

What is the effect of change in REPO and reverse REPO rate on stock market by RBI?

Impact of hike in REPO and CRR in Stock markets There are two types of stock markets - Interest rate sensitive and Interest rate insensitive. There are some industries which depend on loans from banks for expansion. Such sectors which include Banking, real Estate and Infrastructure which are affected adversely if these rates are hiked. The status of this response is Pending and require some modification by the author. Sign up for our Newsletter!

Subscribe to RSS Feeds by Email. Top Contributors Today Hafeez 5 Anwesha 2 Alok Nath Quick Links Ask Experts Forum Articles Reward Programs Blogging Practice Tests.

How Interest Rates Affect Stock PricesAwards Top Earners New Posts. About Us Contact Us Copyright Privacy Policy Terms of Use Trademark Disclaimer.