Trading today black scholes option calculator

An integral part of understanding option trading basics, is mastering the components that influence option value. In other words, is the option overpriced or undervalued?

If, for example, an option is calculated to be underpriced an investor will purchase it and look to sell it when market forces return it to the higher, more appropriate value.

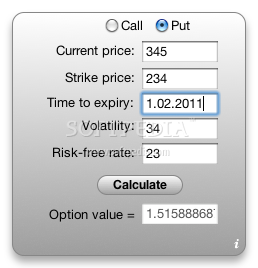

In order to utilize this approach, we would first need to determine the theoretical value a mathematically derived estimate of the value of the contract of the option to determine if it is priced fairly. The most well known of these option pricing models is the Black-Scholes Model introduced by Fischer Black and Myron Scholes in The following option and underlying characteristics need to be known for the calculations:. These parameters are entered into the formula developed by Black and Scholes and a theoretical value for the option is calculated and then compared to the current market value.

There have been several variations of the Black-Scholes Model developed since but the original remains the most popular amongst traders. There are several assumptions made by this model some of which have come under criticism:. Many companies do in fact distribute dividends which may impact call premiums.

Call Option Calculator!One way to adjust the model for this would be to subtract the discounted value of a future dividend from the stock price. Even though the original Black-Scholes model does not take dividends into consideration, an extension of the Black-Scholes Model proposed by Merton in alters the Black-Scholes model in order to take annual dividend yield into consideration.

This model is not as widely used as the original Black-Scholes Model.

Black Scholes Option Calculator Trading Today - My 1-Minute!

We, in fact, use American style options which allow the option to be exercised at any time during the life of the option, making American options more valuable due to their greater flexibility. This limitation is not a major concern because very few calls are ever exercised before the last few days of their life. This assumption suggests that people cannot consistently predict the direction of the market or an individual stock.

The Black-Scholes model assumes stocks move in a manner referred to as a random walk. Random walk means that at any given moment in time, the price of the underlying stock can go up or down with the same probability. Usually market participants do have to pay a commission to buy or sell options. Even floor traders pay some kind of fee, but it is usually very small. Government Treasury Bills day rate can be used since the U.

However, these treasury rates can change in times of increased volatility. The historical volatility is the volatility of a series of stock prices where we look back over the historical price path of the particular stock. To enable us to compare volatilities for different interval lengths we usually express volatility in annual terms.

Black Scholes Option Calculator Trading Today, Strategies And!

See the red area in the standard deviation chart below:. One standard deviation away from the mean in either direction on the horizontal axis the red area on the above graph accounts for somewhere around 68 percent trading today black scholes option calculator the potential price range. Two standard deviations away from the mean the red and green areas account for roughly 95 percent of the price potential.

And three standard deviations the red, green and blue areas account for about 99 percent of the potential prices. The method used by most options traders to determine the theoretical value of an option is the Black-Scholes Model.

Certain parameters are fed into the equation and several assumptions are made to calculate the figure. It is important to understand the strengths and weaknesses of this model as we apply it to our investment strategies. This free bingo sites win real money no deposit has negatively impacted our markets as has continued concerns over the European debt crisis.

This site is taking a conservative and cautious approach as we wait for the debate over the fiscal cliff. We are using in-the-money strikes, low beta stocks and ETFs. Those new to investing with stock options may want to keep some cash on the sidelines. Posted on November 10, by Alan Ellman in Option Trading BasicsStock Option Strategies.

To send us an email, contact us here. Subscribe to our e-mail newsletter or RSS feed to receive updates. Contact us by phone at Additionally you can also find us on any of the social networks below:. The Weekly Report for has been uploaded to the Premium Member website and is available for download. Trading today black scholes option calculator can view them at The Blue Collar YouTube Channel.

For your convenience, the BCI YouTube Channel link is:. You can access it at: On a separate note, Alan presented to the Chicago Area AAII, one of the largest AAII chapters in the country.

There is also a great article imbedded in the home page of ivolatility. The article includes a discussion specific just to covered call writing. I have read that the greeks are important as they relate to option trading. However, it is critical to understand the relationship between share value, time decay and volatility as they relate to option premium and risk degree when using this great strategy. Mail will not be published Required. You can use these tags: Notify me of followup comments via e-mail.

You can also subscribe woolworths trading anzac day 2014 commenting. Optionally add an image JPEG only. Site Disclosure Statement Glossary Sitemap Timeline. Members Log In About Us Glossary for Covered Call Writing Free Resources including Ellman Calculator Ask Alan Training Videos Free Training Videos Events Calendar Facebook FAQ. The Blue Collar Investor Learn how to invest by selling stock options.

Covered Calls Beginners Corner — Cash-Secured Puts The Blue Hour The Blue Hour For Premium Members. The following option and underlying characteristics need to be known for the calculations: About Alan Ellman Alan Ellman loves options trading so much he has written four top selling books on the topic of selling covered calls, one about put-selling and a sixth book about long-term investing. Alan is a national speaker for The Money Show, The Stock Traders Expo and the American Association of Individual Investors.

He also writes financial columns for both US and International publications along with his own award-winning blog. He is a retired dentist, a personal fitness trainer, successful real estate investor, but he is known mostly for his practical and successful stock option strategies. Connect With Us To send us an email, contact us here. Additionally you can also find us on any of the social networks below: Premium Members, The Weekly Report for has been uploaded to the Premium Member website and is available for download.

For your convenience, the BCI YouTube Channel link is: Best, Barry and The BCI Team. Thanks for all your great work. Thanks for your support: Subscribe Here - Have the latest blog articles sent to your inbox. Subscribe to this articles Comments via RSS Feed. Learn how to take a Screenshot so you can add it to your comment. Leave a Reply Click here to cancel reply. Executing Covered Call Trades: The Buy-Write Combination Form. July 15, 8: Washington DC Chapter AAII- Summer Workshop.

The New Stock Market- Algorithmic and High Speed Trading January 15, Options That Expire Weekly and Conventional Expiration Cycles September 26, Short Selling: Positives and Negatives January 30, The CBOEs Volatility Index VIX September 11, Penny Pilot Program October 29, Roni Thanks Barry, I was trying to enter a covered c Barry B Hi Roni, WCN had a 3 for 2 stock split on June Alan Ellman Randal, Yes.

When a strike expires in-the-money Alan Ellman Luis, When I first started with covered call wr Alan Ellman Roni, You made my day. Keep up and good wor. Recommended Investing Links DR. Eric WIsh's Wishing Wealth Blog.

Archives Archives Select Month June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October July June May March January December October September August June January December November September August July June May April March February January December November October September August July June May April March January December About BCI The Blue Collar Investor was NOT a brilliant idea of mine….

I was a frustrated blue collar investor just like you.